A holding abroad – what's wrong with that?

A LAT business has a holding company in CYP (MLT, LUX, NED, etc.). What could be the tax consequences of this? And why are the holding company's jurisdictions afraid of the questions posed to the ECJ?

Contents:

Typical situation

What might the Latvian State Revenue Service be interested in in such situations?

Capital growth

Permanent establishment

CFC

What is Latvian Maxima disputing in the EU court?

Why did we, unlike other consultants, not recommend such a structure?

Neo Group Lithuanian case in the EU court

But many people do it!

Parallel income

Investment before sale

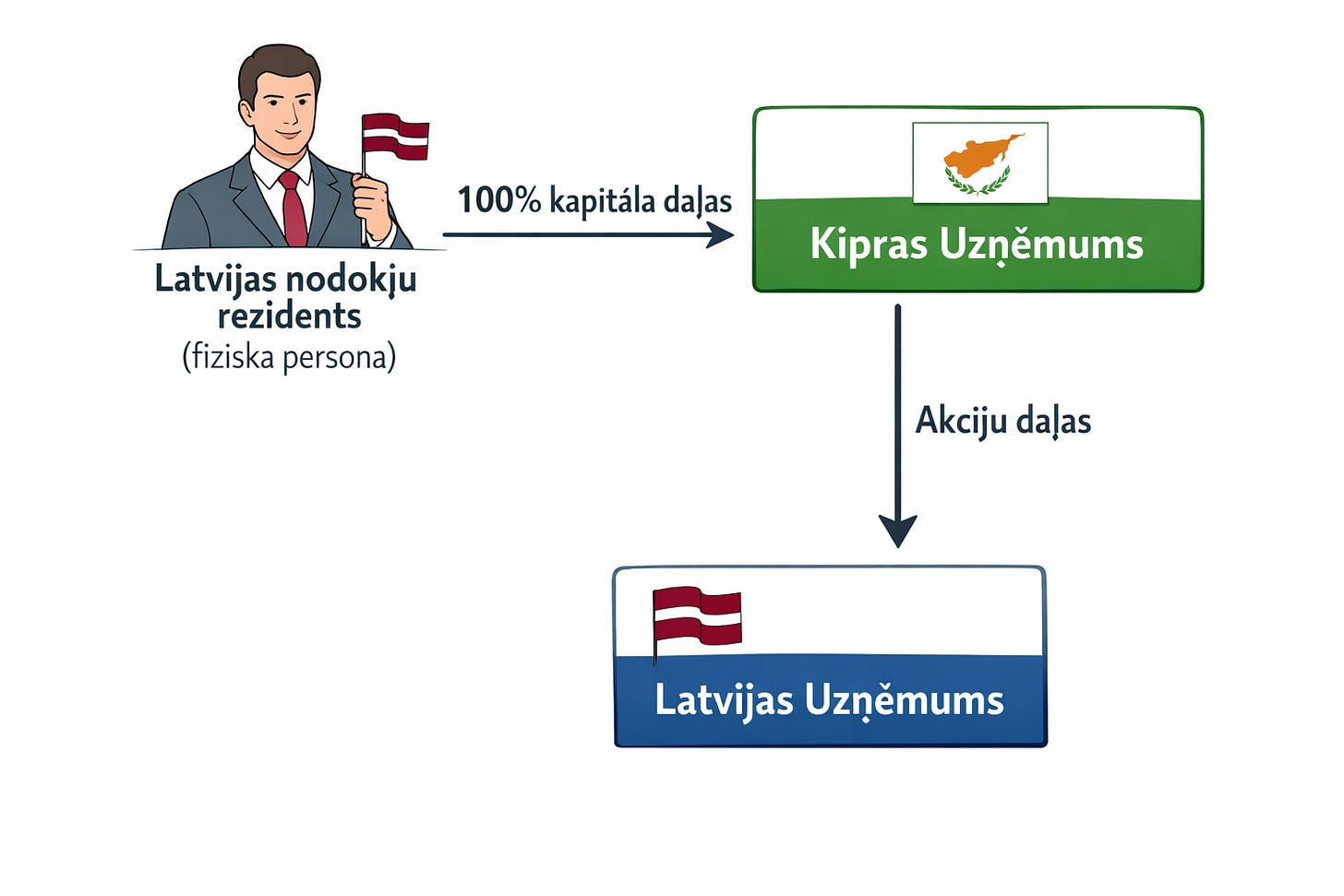

A typical situation

So, a Latvian tax resident (natural person) owns 100% of the shares in a Cypriot company, which in turn owns a portion of the shares in a Latvian company. This situation is not uncommon, as 20 years ago it was a consultant’s bread and butter - to persuade businesspeople that this was safer, more correct, etc. Let’s model what the consequences are now and what some of the latest EU court cases are in this regard.