How did taxes come about?

F.H.M. Grapperhaus has expressed some interesting theories on this subject in his book Taxes Through the Ages. It is suitable reading material for a flight to Egypt.

In this blog:

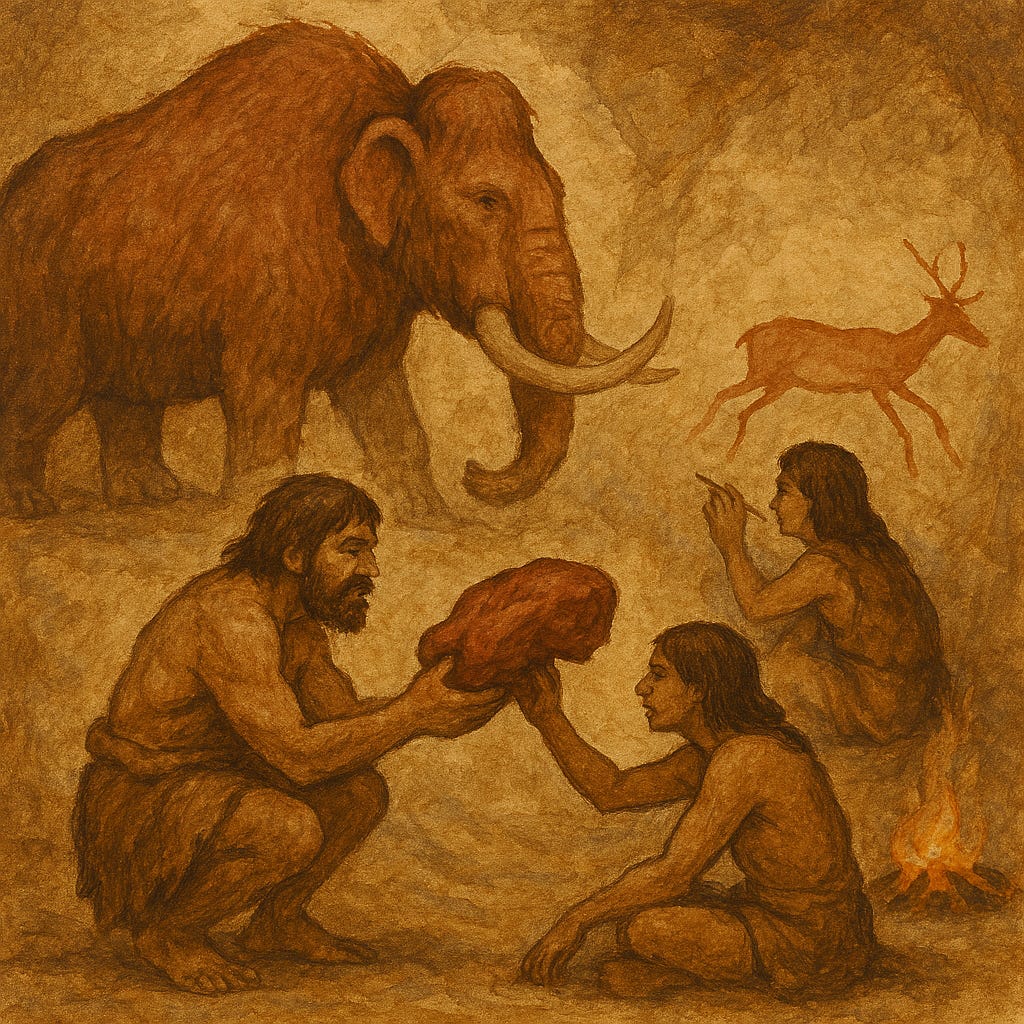

• 🦣 Cave people share mammoth meat with hearth keepers and cave painters.

• 🛡️ Villagers behind fortifications negotiate with raiders offering “protection.”

• 🌊 Ancient Egyptians measure the water level of the Nile to calculate possible taxes.

• 📜 Strict tax collectors collect duties.

• 🏗️ Pyramid construction with forced labor, symbolizing the blurred line between taxes and work.