VAT in chain & triangulation transactions

The Senate referred questions to the EUCJ. However, it was not easy to determine what the dispute was about, as supply chains (multiple sales with a single transport) are one of the most complex areas

Contents:

What happened?

What did the SRS claim?

What are the consequences?

I would like to highlight this particular claim by the SRS

Fraud?

Unjustified fiscal advantages?

Example with 0%

Example with 21%

The essence of neutrality

Unjustified state enrichment

What the Senate is asking the ECJ and what my answers would be

Applicable VAT law

Reflections on the case

It is irrelevant when ownership rights are transferred

Incoterms do not determine the moment of transfer of ownership rights

It is irrelevant that these were excise goods

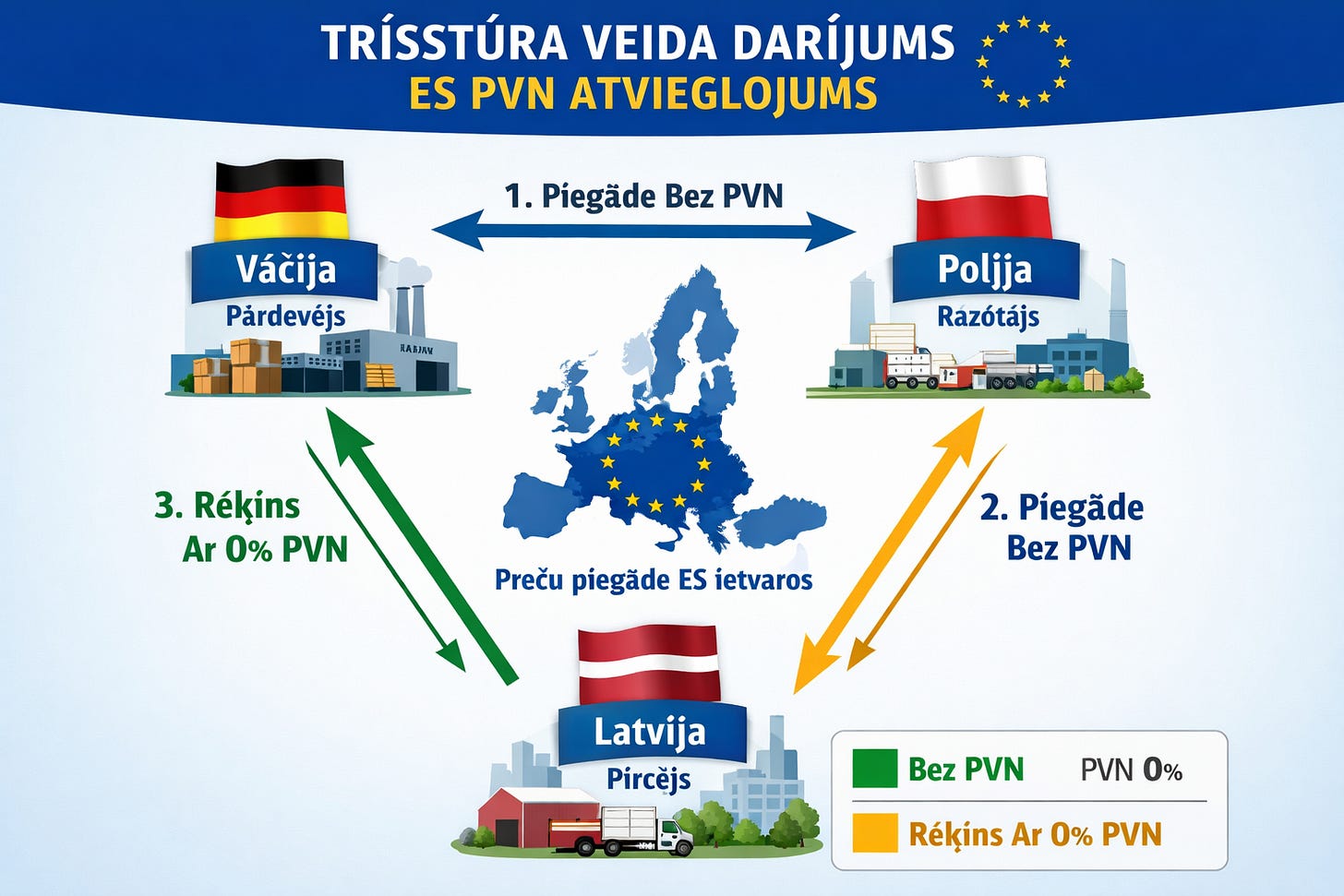

How to determine whether it is a triangle or a quadrangle?

Why is it not advantageous for Latvia not to register VAT payers retroactively?

What are LLP partners? Offshore companies?

What happened?

This case concerns the application of VAT to supplies of excise goods (petroleum products) under the deferred tax regime. The deliveries involved sellers in Latvia, intermediaries in Estonia and the United Kingdom, as well as buyers in other EU countries. The goods were delivered from Latvia to end buyers in other EU countries. Transport was provided by buyers in third EU countries. For now, it looks like a classic triangle.